It's difficult to be a new to the market and learning how to navigate the sharks in addition to learning the market.

So you go on twitter or stock twits trying to learn and see everyone is talking about how great a trader Tim Sykes is, or Super Traders, or the Investors underground. You are immediately amazed by the gains they claim to be making. So you do some search reviews and you see a bunch of glowing reviews for the service all with links to that source. The services are not cheap, but if they make you a millionaire so what. Then you try the service and your experience is nothing like the reviews and you quickly blow out.

Here's why that occurs:-- Affiliate programs. For example, Profitly, which several of these "Gurus" use to market their services rely on affiliate marketing. According to the terms:

In other words, if you sign up to a service the affiliate gets 30% or more. That is a huge incentive to sell you a shit sandwich and tell you its great. And people are doing it to scam you.

Here's just one website, I found My Super Advertures in Stock Trading that appears to be nothing more than a platform for affiliate marketing. But according to him, he's learned all the secrets of penny stock trading from Tim Sykes and Supertrades.

In short, whenever you see reviews that are too glowing, or bargaining about gains that seem large be skeptical. There are worthwhile services out there, but you shouldn't be committing a large portion of our equity on services.

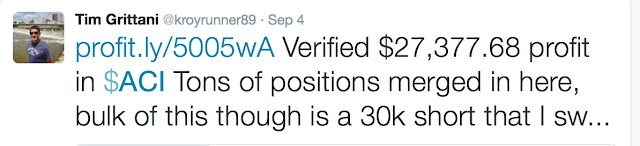

Also, while I'm on my rant, top traders rarely not talk their trades in dollar amounts, They talk about gains in terms of % of equity and % of risk. So If you see someone on twitter brag about a gain and have something to sell:

Remember it means nothing without context.

How big is the account? What % of equity was risked on the trade? Of course, posting < % Equity gains isn't likely to grab the readers' attention.

Be skeptical, define your own setups, and trade your own trades.

Stay safe out there,

Scot1and

No comments:

Post a Comment