I'm working on refining the trigger for my slingshot setup. If I combine the setup with my "Thurst" indicator: -- a 4EMA of the HIGHS -- --- This setup is to target a reversal of a shallow pull back. I would consider any new thrust as anything more that 4 pull back bars.

NOTE: I do not keep my charts this messy ... this is for illustrative purposes only.

I'm encouraged with what I see:

Wednesday, October 21, 2015

Tuesday, October 20, 2015

Mark Minevrini Notes

Mark Minevrini

SEPA

1. Identify Trend template

2. Fundamental Scan-- growth Sales / margins, relative strength

3. Leadership

4. Manual Review

Influenced by Weinstein

Stage 1 characteristics:

Goal is not to buy cheapest price-- its to buy the right price-- we want stocks that move quickly after you buy them.

Transition from 1 to 2:

Stage 2 will show volume--- should always be a rally of 25-30% before you conclude Stage 2 has begun.

Transition Criteria

Series of higher lows, above 150 and 200 ema

Weekly Charts

Large volume spikes on up weeks

in contrast to low volume pull backs.

Stage 2 Characteristics:

>40Week and 40 week ema in uptrend

Staircase pattern-- clear uptrend

Stage 2/ 3 transition -- VOLATILITY increases

Major price break on volume

200 DMA flattens

Stage 4: capitulation --

price breaks

Conclusion-- Big money is identifying when stage 2 begins

Ride the waves

Within a trend (tide) there will be short term oscillation (waves)

There can be basing 5-25 weeks in a stage 2

Base count-- should stair case up a stage 2, stock typically has 3 to 5 bases.

You want to get in when institutional money is getting in.

When the leader sneezes the industry catches a cold

Look for contraction areas:

SEPA

1. Identify Trend template

2. Fundamental Scan-- growth Sales / margins, relative strength

3. Leadership

4. Manual Review

Influenced by Weinstein

- Every super stock starts big performance in stage 2.

Avoid buying stage 1 no matter how good the fundamentals may be.

Stage 1 characteristics:

- -- price oscillates around 40 week / 200 dma

- Can last years

Goal is not to buy cheapest price-- its to buy the right price-- we want stocks that move quickly after you buy them.

Transition from 1 to 2:

Stage 2 will show volume--- should always be a rally of 25-30% before you conclude Stage 2 has begun.

Transition Criteria

Series of higher lows, above 150 and 200 ema

Weekly Charts

Large volume spikes on up weeks

in contrast to low volume pull backs.

Stage 2 Characteristics:

>40Week and 40 week ema in uptrend

Staircase pattern-- clear uptrend

Stage 2/ 3 transition -- VOLATILITY increases

Major price break on volume

200 DMA flattens

Stage 4: capitulation --

price breaks

Conclusion-- Big money is identifying when stage 2 begins

Ride the waves

Within a trend (tide) there will be short term oscillation (waves)

There can be basing 5-25 weeks in a stage 2

Base count-- should stair case up a stage 2, stock typically has 3 to 5 bases.

You want to get in when institutional money is getting in.

When the leader sneezes the industry catches a cold

Look for contraction areas:

Sunday, October 18, 2015

Al Brooks Price action Trading course

A friend shared me this video on price action trading.

Most things work 40-60% of the time. There is no holy grail.

5% of the time market is in a strong breakout, no decision trade in the direction of the trend.

In 5% clear trend. -- Ascertain direction and get in quickly. Buy close of bull bars- pull backs.

95% not in a pure trend-- both bulls and bears can make money.

Initial risk, every trader has initial risk that is different.

Actual risk.--- number of ticks needed to not take a loss on that trade.

Target needs to be as big as risk.

When probability not in trend. need 2x risk.

Wider stop = smaller size.

A lot of profit at 1 x 2 times risk. Computer driven.

Assume institutions are profitable. Always an institutional seller and buyer. In general there is balance.

Most things work 40-60% of the time. There is no holy grail.

5% of the time market is in a strong breakout, no decision trade in the direction of the trend.

In 5% clear trend. -- Ascertain direction and get in quickly. Buy close of bull bars- pull backs.

95% not in a pure trend-- both bulls and bears can make money.

Initial risk, every trader has initial risk that is different.

Actual risk.--- number of ticks needed to not take a loss on that trade.

Target needs to be as big as risk.

When probability not in trend. need 2x risk.

Wider stop = smaller size.

A lot of profit at 1 x 2 times risk. Computer driven.

- Take partial profits at min equation as of 2x actual risk.

- There is a profitable way to manage both short and long

Assume institutions are profitable. Always an institutional seller and buyer. In general there is balance.

- Market spends most of the time at point of the control.

PROBABLILTY IS THE SOURCE OF ALL EMOTION OF TRADER

- Makes beginners not entry too early or too late

- Reward should be at least equal to risk.

- if uncertain 40-50% of the time--- need 2x risk.

- Institutions can enter profitably on any tick on the day. They have a profitable strategy and employ it.

- Hedge in other markets

- Our edge is to trade setups. Always near support or resistance. Risk is small-- buying on support or probability is high.

- Profits disappear quickly.. take at least 1/2 at profit target.

Buying breakout --- there's an institution betting on failure of breakout.

Trading only profitable market structures.

Short at the bottom of a trading range should not be fighting with 2 sided trading.

Saturday, October 17, 2015

2 Week Rest Rule

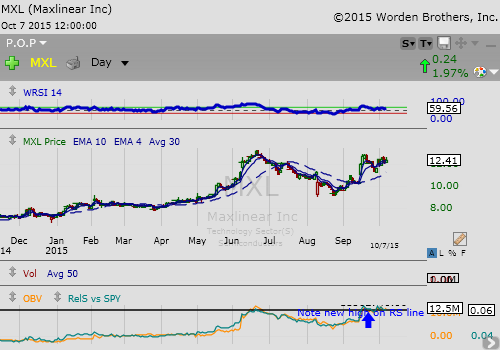

One of Mauthe's criteria is that a new breakout must rest for 2 weeks before re-breaking out. Here's an example of this "rule" in action:

Weekly:

Weekly:

Thursday, October 8, 2015

Wednesday, October 7, 2015

Sunday, October 4, 2015

Saturday, October 3, 2015

Don't Get Fooled by The Affiliates

It's difficult to be a new to the market and learning how to navigate the sharks in addition to learning the market.

So you go on twitter or stock twits trying to learn and see everyone is talking about how great a trader Tim Sykes is, or Super Traders, or the Investors underground. You are immediately amazed by the gains they claim to be making. So you do some search reviews and you see a bunch of glowing reviews for the service all with links to that source. The services are not cheap, but if they make you a millionaire so what. Then you try the service and your experience is nothing like the reviews and you quickly blow out.

Here's why that occurs:-- Affiliate programs. For example, Profitly, which several of these "Gurus" use to market their services rely on affiliate marketing. According to the terms:

In other words, if you sign up to a service the affiliate gets 30% or more. That is a huge incentive to sell you a shit sandwich and tell you its great. And people are doing it to scam you.

Here's just one website, I found My Super Advertures in Stock Trading that appears to be nothing more than a platform for affiliate marketing. But according to him, he's learned all the secrets of penny stock trading from Tim Sykes and Supertrades.

In short, whenever you see reviews that are too glowing, or bargaining about gains that seem large be skeptical. There are worthwhile services out there, but you shouldn't be committing a large portion of our equity on services.

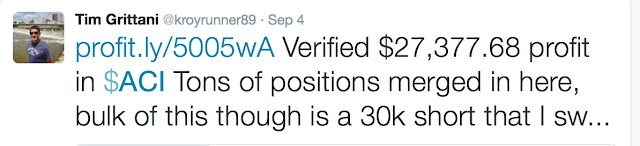

Also, while I'm on my rant, top traders rarely not talk their trades in dollar amounts, They talk about gains in terms of % of equity and % of risk. So If you see someone on twitter brag about a gain and have something to sell:

Remember it means nothing without context.

How big is the account? What % of equity was risked on the trade? Of course, posting < % Equity gains isn't likely to grab the readers' attention.

Be skeptical, define your own setups, and trade your own trades.

Stay safe out there,

Scot1and

So you go on twitter or stock twits trying to learn and see everyone is talking about how great a trader Tim Sykes is, or Super Traders, or the Investors underground. You are immediately amazed by the gains they claim to be making. So you do some search reviews and you see a bunch of glowing reviews for the service all with links to that source. The services are not cheap, but if they make you a millionaire so what. Then you try the service and your experience is nothing like the reviews and you quickly blow out.

Here's why that occurs:-- Affiliate programs. For example, Profitly, which several of these "Gurus" use to market their services rely on affiliate marketing. According to the terms:

In other words, if you sign up to a service the affiliate gets 30% or more. That is a huge incentive to sell you a shit sandwich and tell you its great. And people are doing it to scam you.

Here's just one website, I found My Super Advertures in Stock Trading that appears to be nothing more than a platform for affiliate marketing. But according to him, he's learned all the secrets of penny stock trading from Tim Sykes and Supertrades.

In short, whenever you see reviews that are too glowing, or bargaining about gains that seem large be skeptical. There are worthwhile services out there, but you shouldn't be committing a large portion of our equity on services.

Also, while I'm on my rant, top traders rarely not talk their trades in dollar amounts, They talk about gains in terms of % of equity and % of risk. So If you see someone on twitter brag about a gain and have something to sell:

Remember it means nothing without context.

How big is the account? What % of equity was risked on the trade? Of course, posting < % Equity gains isn't likely to grab the readers' attention.

Be skeptical, define your own setups, and trade your own trades.

Stay safe out there,

Scot1and

Subscribe to:

Posts (Atom)