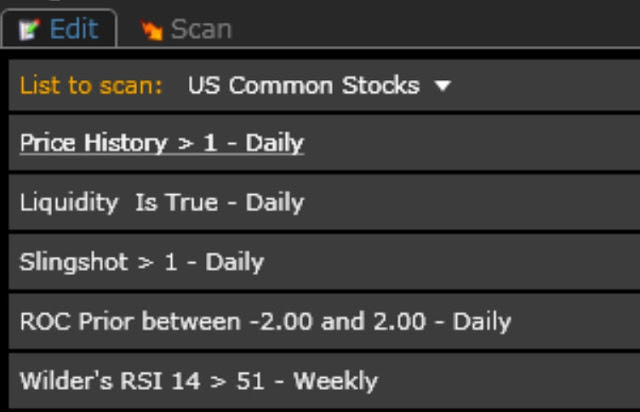

Over the weekend, I spent some productive time working out a new power setup with a couple of my

trader friends. We are fondly calling this setup the "Slingshot."

This setup takes a stock that recently had a power move and has stretched back under the EMA 4 --- but not too far-- The EMA 9 should be the limit. When it gets pulled back through the green side of the EMA 4 it has accumulated power and is ready to go.

The great thing about this setup is that it gets you in power stocks sooner, with tighter stops then waiting for a breakout.

Here's a perfect example: EFOI gets stretched through the 4 to the 9. I picked it up at 13.24 as it came back through.

How did it do? Only about 40% in the next 2 days.

TREE:

Aftermath: +20pt move and counting

SPNS:

EVHC:

Under the surface:

I'm a big fan of hourly charts. The weekly gives you the trend. The daily gives you the landscape, but it is the hourly that gives you the entry.

That said, I can get jumpy and I did this morning in ALJ. It retook the 4 and broke the hourly downtrend channel in the first inning of today. So I took a position. It was stuffed and I took a stop.

I'd be far better off waiting for 2 hour bars for confirmation.

Done correctly:

Follow through:

After the Slingshot shoots, the EMA 4 should never be breached on a close. Consider it the trailing stop on the position. Of course, take profits on the way up.

After I presented, this post I had a follow up question as to how this differs from the

Fishhook. There are two significant differences.

First, is the timing. The Fishhook was designed for Week 1 moves. Power move rest two days and boom!

The second is the trigger point. The fishhook buys on confirmation when the first day high is taken out. The Slingshot buys lower when the 4EMA is reclaimed. (but again consult the shorter timeframe such as the hourly-- we want to see a break of the downtrend channel)