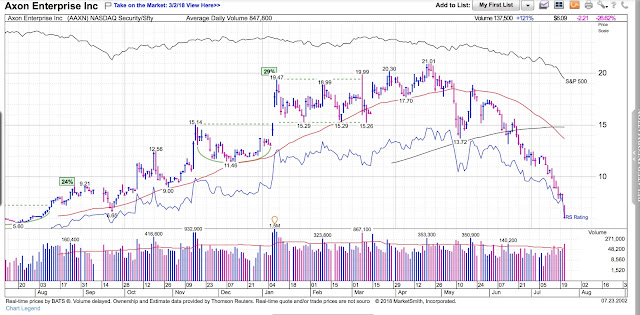

The first was its IPO run:

ripped out of the IPO new high, Took a revisit and then was off to the races. It was a very jumpy stock and would be hard to ride, but for those who did.

After making a new high

Here's a big warning sign that the IPO run is nearing an end. Notice the big volume breakout could't hold and it got stuffed on a bigger volume.

More warning signs.

TASR attempted to rally off the dip but, it was held back at the same levels it previously was accumulated at.

And like Many IPOs, TASR suffered the Fly and die fate.

But a 7 to 20 run not bad.